As most charities that acknowledge auto donations achieve this frequently, they’ll most likely have the procedure all the way down to a science and contend with every one of the donation documentation paperwork needed via the IRS for yourself.

The charitable Firm enhances the price of the car or truck substantially by way of repairs (not merely cleansing or painting).

The proceeds with the sale of your vehicle donation, truck donation, and even boat donation should help offer the mandatory funding for analysis directed at obtaining new methods to detect, take care of and prevent breast cancer.

However, Understand that as an international Business, your donation will not likely have as much direct influence on your local people as other charities Within this record.

Receive the tailor-made practical experience that you just assume through the tax litigation professionals in your area. Click your condition to start!

From the early 1900s, the federal governing administration formalized the American Purple Cross's spot in wartime and peacetime by way of an official Congressional charter.

By offering us your e mail address, you will be signing up to acquire e-mails from St. Jude. By offering us your email handle and/or cell phone amount, you might be signing as much as acquire email messages and periodic textual content messages from St. Jude. You can opt-out of such messages at any time. Thanks

Your donation to your Make-A-Wish Basis will profit your local chapter, this means it is going to go toward supporting Young children directly in your Neighborhood.

Why we chose it: Motor vehicles for Veterans does not deliver just a handful of expert services to veterans, but it surely in fact raises cash to donate to an assortment of veteran-centered charities.

CDF is really a nonprofit that operates quite a few automobile donation programs, including types benefiting Wheels for Needs here and Animal Vehicle Donation. It accepts most car or truck forms, picks them up free of charge to you and can take care of each of the paperwork.

Is the fact 20-year-old sedan amassing dust? It could be why a having difficulties college student gets a 2nd probability at graduating. The minivan no one drives any more info longer? It could support fund transportation for kids who'd or else have no method of getting to school. The beat-up truck that’s been sitting untouched for website months? It could be reworked into mentorship systems, scholarships and faculty provides.

Normally, you could only deduct the amount that the charity sells the car for at auction as indicated within the penned receipt the charity sends you.

The value read more is decided with the gross proceeds raised within the sale with the donated automobile. You now not provide the burden of pinpointing the value yourself.

In the event the organization sells your donated car or truck, you are check here going to generally deduct your vehicle's honest sector worth. However, several nuances can come into Enjoy, so for a full comprehension of deducting your automobile donation, it's best to refer to the IRS's guide for auto donation.

Mr. T Then & Now!

Mr. T Then & Now! Brandy Then & Now!

Brandy Then & Now! Destiny’s Child Then & Now!

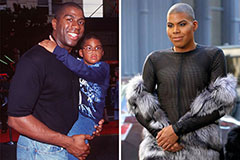

Destiny’s Child Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now!